6 Money Apps Teens Can Use To Manage Their Spending

You can address your young people about how they spend their money just to such an extent. In addition, they can address back: Maybe you purchase costly espresso or filtered water or pay for an exercise center participation you never use.

Rather, you might need to propose that your youngsters experiment with some cash the board applications. At the end of the day, redistribute a portion of your addressing and oversight to innovation.

Or on the other hand continue hectoring your children, in the event that you like. In any case, you could do both. Cash the board applications can be a valuable device for instructing youngsters better ways of managing money, and they can be a viable methodology for helping you and your kids impart better about your funds. We should investigate some applications you may need your teenagers to download.

1.Greenlight

It's a platinum card with parental controls for kids. You can screen their record, and they can as well. So on the off chance that they're going to go into a store and have a cell phone, they can check their equalization, which they should need to do, since on the off chance that they attempt to burn through cash that isn't on the card, the exchange will be declined. Keep in mind the first occasion when you encountered that embarrassment? Your teenager could maintain a strategic distance from that soul changing experience by and large. That is advance.

There are some cool highlights past the check card part. You can set up a record so your young people set aside extra cash and gather enthusiasm on it. (The premium will originate from your ledger, unfortunately, and not from Greenlight.) You could organize it so your children get 10 percent premium consistently (much better than any bank, obviously) so they can see the intensity of investment funds and premium.

The evaluating is $4.99 every month per family.

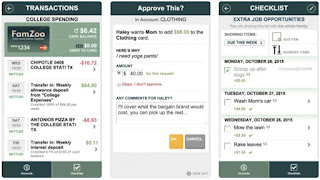

2.FAMZOO

This is an individual fund application that says it's optimal for preschoolers through school, and it's useful for guardians.

You can utilize it to fill in as an innovative recompense framework: You set errands for your children to do, and expecting they finish and do them, you discharge cash to their records. For the young people, you can get them prepaid cards. You can see the exchanges your high schooler is making, and you can stack cash on the cards whenever. Obviously, since there are expenses for this ― after a free time for testing, you pay $5.99 every month, less on the off chance that you prepay ― you may ask why you shouldn't simply utilize your very own bank and get your child a record that you can screen. In any case, you can't get overdraft charges with FamZoo, which is a major selling point.

3. PLAN'IT PROM

Are your adolescents wanting to go to prom? Better believe it, there's an application for this as well. As the duplicate at the Apple Store guarantees you, this is the "complete prom arranging and planning application for understudies and guardians, joining a prom commencement, course of events, spending adding machine and spending wellbeing meter into a format that is fun and simple to utilize."

As indicated by a regularly refered to 2015 report by Visa in 2015, heading off to a prom costs $919, by and large. So from one viewpoint, this application is presumably distressfully required. On the other, your financial balance is presumably going to feel a while later as though it had been robbed, regardless of what number of cash the board applications you use.

4. BUSYKID

This application says that it's a solid match for children ages 5 to 16, however it's difficult to envision such a large number of young people being too amped up for utilizing an application with "kid" in the name. Regardless, it might merit investigating. The application is intended to show your kids how to win, spare, spend and contribute. BusyKid's highlights incorporate having the capacity to allot errands and different undertakings to your kids. They get a record; you have a record. Your children get programmed paydays every Friday, if you check on the application that the tasks have been done, and your children can procure rewards for additional errands they do.

On the off chance that you need your young people to accomplish more around the house and become familiar with the estimation of work, it could be a decent application to begin utilizing. There is an expense of $14.95 every year per family.

5.TIP YOURSELF

This is an application that guardians should need to utilize as well, since it's truly intended more for grown-ups, yet like the Mint application underneath, adolescents may profit also. It's an entirely cool idea: Why not remunerate yourself when you accomplish something great? It's a propensity building application that gets you into an example of setting aside extra cash for yourself, just as structure different propensities. So if your adolescents have keeping an eye on or work at a cheap food joint or wherever, you could urge them to set aside a portion of their cash each time they get paid, in light of the fact that it's brilliant. Or then again if your adolescents are applying for school, they can send $10 to their tip container each time they round out an application. In case you're endeavoring to get yourself to peruse more or jump on the treadmill, possibly you give yourself $5 each time you do that.

You get the thought. The cash goes from your financial records to a tip container overseen by the FDIC-guaranteed NBKC Bank.

6. MINT

Comments

Post a Comment